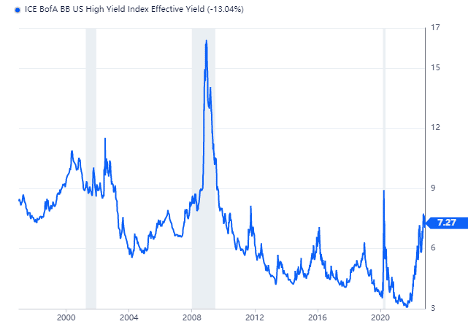

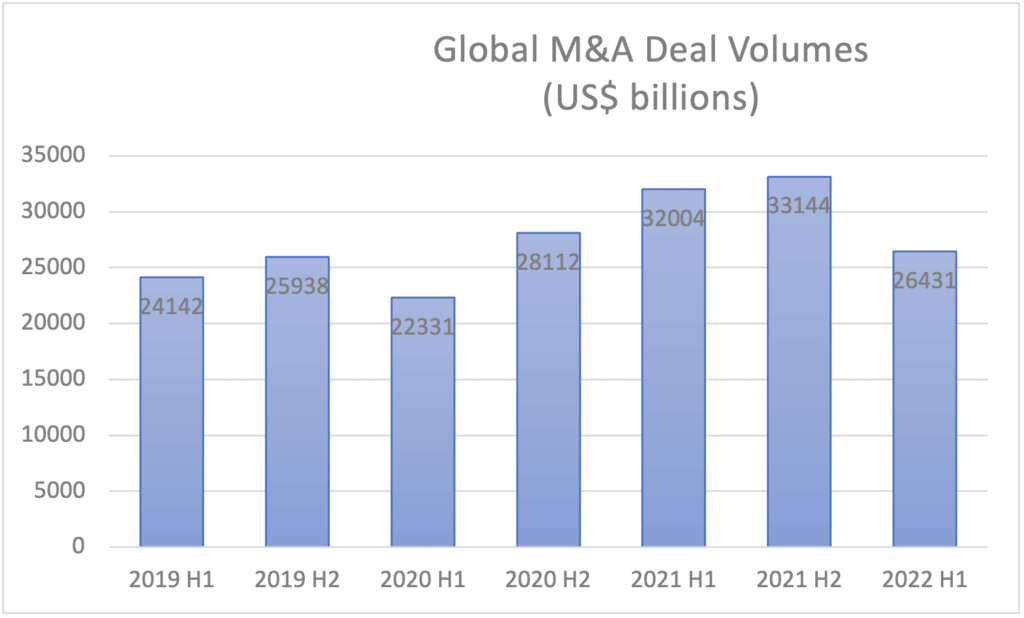

The M&A market is facing strong headwinds going into 2023. Debt capital markets have become increasingly expensive and cautious, with the US High Yield BB Effective Yield hitting 7.27 percent at the end of October, up from 3.42 percent a year earlier. This, plus uncertainty over inflation, geopolitical instability, and declines in once-hot sectors such as software, has caused global M&A volumes in the year to September 30 to fall 34% from the year-earlier period, according to Refinitiv, a data company, as the graph below illustrates

Nonetheless, the market has not come to a standstill. More uncertainty and the higher cost of financing M&A transactions has made people more discriminating. However, companies looking to expand and the owners of well-run companies who wish to monetize or exit those businesses are still getting deals done.

Table of Contents

Motives for Dealmaking

A few new mega-deals are in the works. For example, Johnson & Johnson recently agreed to buy cardiovascular tech company Abiomed for $16.6 billion. However, many of the deals currently in the works involve private, mid-sized companies.

Even in a volatile economic environment, owners of private companies might decide they simply wish to retire for personal reasons, or they may want to monetize all or part of their company to raise capital for new growth investments. With the IPO market unreceptive to most issuers right now, a sale, merger or divestiture could be their best bet.

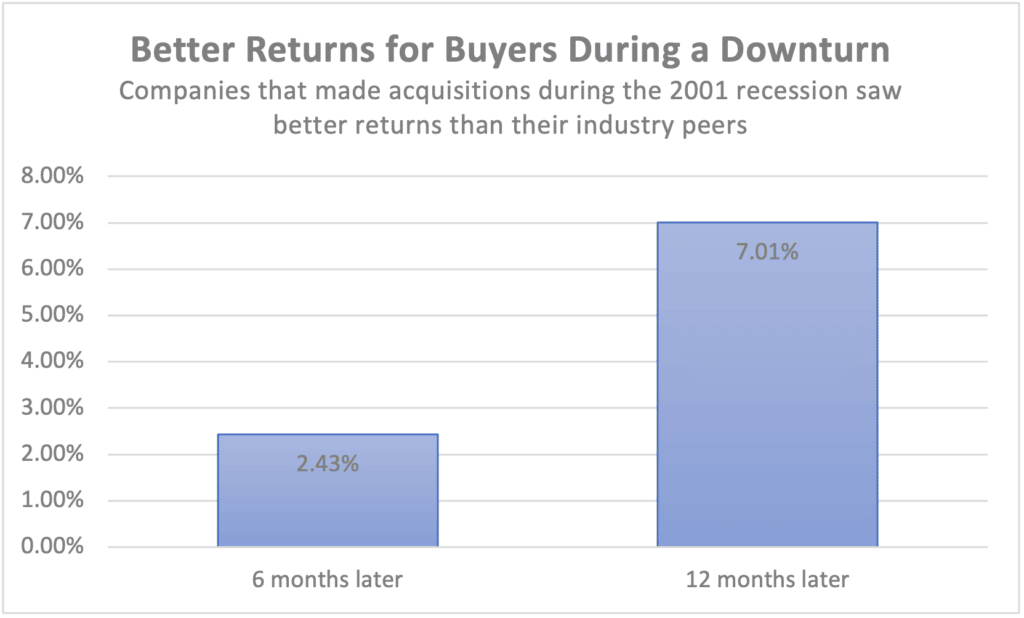

From the perspective of buyers, the best deals are often made during the worst economic times. A PwC analysis, M&A cycles: Fundamental drivers and valuation impacts of acquisitions made during different economic cycles, found that they often outperform. The authors wrote, “In the recession from March to November 2001, marked by the dotcom bust, the median shareholder returns for companies that made acquisitions outpaced their respective industries in the following months, rising as high as 7 percent one year after the transaction was announced.”

Median returns for each deal versus the relevant S&P 1500 sector index

Source: PwC article linked here

PwC further reported that “More than 900 companies made 1,600-plus deals during that recession. In several sectors – including consumer durables, insurance, media and entertainment, and healthcare equipment – the median returns for those acquirers after a year were higher than the overall sector by double digits.”

Flight to Quality

Even with motivated buyers and sellers, both parties need to be particularly careful about getting deal fundaments right. In a recent article, Global M&A market slows in 2022 first half—but shows signs of strength, McKinsey & Co.’s M&A team wrote, “Value capture is really important in a market like this because we have to mitigate the headwinds that companies face: rising commodity prices, rising energy prices, increasing labor costs. As a result, we must get far more specific, far more accurate, and go far deeper in value creation.” This requires the right organizational structure, operating model, talent, and culture, the report noted.

Inflation makes these analyses particularly difficult, especially since few dealmakers and managers have operated in inflationary environments – currently over 8 percent in the U.S. and in breaching double-digits in Europe. In its mid-year M&A trends report, PwC cautioned, “Dealmakers need to take into account both present and expected future inflation in their valuations. This involves forecasting different inflation scenarios and using real-time analytics to assess the impact of inflation on the company’s operations and earnings. Pricing, cost management, and cash flow are part of a company’s response to operating in an inflationary environment, and require an understanding of the wider implications on market share, price elasticity, customer and supplier relationships, and employee compensation and retention.”

Source: PwC Mid-Year Trends Report

At DGP Capital, we are hearing a similar message from both strategic and financial buyers – while they continue to actively seek M&A opportunities, the threshold for being an attractive target to such buyers has gone up. Buyers are paying closer attention to risk factors such as revenue volatility, customer concentration, lack of sustainable management and leadership, and passing on deals that have too many of these and other risk factors. Nonetheless, well-run companies with a consistent performance profile continue to receive multiple offers, and in the case of the lower middle market, multiples have remain consistent in spite of growing financing and macro risks.

Getting to Yes

Agreeing on a valuation in this environment will probably be more difficult than in normal times. Buyers may want to pay less to reflect the current depressed equity market conditions, and to offset the potentially higher cost of debt in financing transactions.

Some observers suggest that one way to resolve this potential issue with valuation gaps would be to bring “earn outs” back into vogue. According to a research note from Foley and Lardner LLP, There is No Crystal Ball: U.S. M&A Trends and Predictions, earn outs were included in only 20 percent of post-Pandemic transactions, the lowest percentage in a decade. These legal provisions, which provide a base payment to a seller and subsequent additional payments if it achieves certain revenue or earnings goals, could be a way for buyers to hedge their risks and for sellers to participate in the future success of the company.

An important signal that a seller is serious about managing all these aspects of a transaction competently is the quality of its M&A advisory company. It should have deep expertise in the relevant industry sector, and the ability to bring together best-in-class resources. In volatile times, having this type of experience will be crucial to engineering a successful transaction. Our team at DGP Capital continues to see quality deals completed and would be delighted to serve any companies seeking guidance on exit planning or financing during these volatile times.